How can you protect yourself from fraud?

Fraudsters will do anything in their power to deceive someone, whether that’s online, over the phone or on your own doorstep. We are committed to protecting you and helping you be aware of the types of fraud out there and how you can spot them.

This page covers different types of fraud and the steps you can take to protect yourself, you can read more about what Principality are doing to protect you online here. If you believe that you are a victim of fraud, please contact Principality immediately.

- Authorised push payments

- Money mule

- Identity Theft

- Cheque fraud

- Rogue Traders

![]() Authorised push payment fraud happens when fraudsters deceive consumers or individuals at a business to send them a payment under false pretenses to a bank account controlled by the fraudster. As payments are made using real-time payment schemes are unchangeable, the victims cannot reverse a payment once they realise they have been conned.

Authorised push payment fraud happens when fraudsters deceive consumers or individuals at a business to send them a payment under false pretenses to a bank account controlled by the fraudster. As payments are made using real-time payment schemes are unchangeable, the victims cannot reverse a payment once they realise they have been conned.

Investment fraud, share fraud and boiler room scams

It is likely that you have been targeted by investment scammers if you’ve been flooded with phone calls, letters or emails pressuring you to invest quickly in a once in a life time opportunity. Scammers of this nature will deliver a polished sales pitch and often present offers as ‘exclusive’ and tell you not to discuss them with anyone else. They offer investments in ‘unique commodities’ like wine, land banking, carbon credits, diamonds and graphite. Potential victims will be promised high returns but these will usually be worthless.

Share or boiler room fraud involves bogus stockbrokers, cold calling people to pressure them into buying shares that promise high returns. In reality, the shares are either worthless or non-existent.

How to protect yourself from being a fraud victim:

![]() If you're considering any type of investment, remember - if it seems too good to be true, then it probably is

If you're considering any type of investment, remember - if it seems too good to be true, then it probably is

![]() Always be wary if the initial contact is a cold call or unsolicited email or letter

Always be wary if the initial contact is a cold call or unsolicited email or letter

![]() Don't be forced into making a quick decision

Don't be forced into making a quick decision

![]() Fraudsters often imitate reputable authorised firms, so confirm the scheme is genuine by calling the firm yourself. Use the contact details from the FCA register

Fraudsters often imitate reputable authorised firms, so confirm the scheme is genuine by calling the firm yourself. Use the contact details from the FCA register

![]() Consider obtaining independent professional advice before making any investment decision, particularly if you're not familiar with that type of investment

Consider obtaining independent professional advice before making any investment decision, particularly if you're not familiar with that type of investment

You can visit the FCA ScamSmart investor page on their website to find out more about scams including how to avoid investment scams and report a scam or unauthorised firm.*

Money mules are recruited, sometimes unwittingly, by criminals to transfer illegally obtained money between different bank accounts. Money mules receive the stolen funds into their account, they are then asked to withdraw it and wire the money to a different account, often one overseas, keeping some of the money for themselves.

Even if you’re unaware that the money you’re transferring was illegally obtained, you have played an important role in fraud and money laundering, and can still be prosecuted. Criminals will often use fake job adverts, or create social media posts about opportunities to make money quickly, in order to lure potential money mule recruits.

Money Mules could be criminally prosecuted for carrying out the transactions, their accounts could be closed and they could be held liable for the value of the transactions they received.

If you've got any concerns about being asked to carry out transactions through your own Principality account on another person's behalf, please speak to us straight away.

A few tips on how to prevent yourself being used as a money mule:

![]() Be cautious about any unsolicited offers or opportunities offering you the chance to make some easy money

Be cautious about any unsolicited offers or opportunities offering you the chance to make some easy money

![]() Take steps to verify any company which makes you a job offer, and check their contact details (address, phone number, email address and website) are correct, and whether they are registered in the UK

Take steps to verify any company which makes you a job offer, and check their contact details (address, phone number, email address and website) are correct, and whether they are registered in the UK

![]() Don't respond to unsolicited job offers that arrive by email

Don't respond to unsolicited job offers that arrive by email

![]() Beware of companies offering substantial 'work from home' tasks requiring no experience

Beware of companies offering substantial 'work from home' tasks requiring no experience

![]() Never give your bank details to anyone unless you know them

Never give your bank details to anyone unless you know them

![]() No company should ask you to carry out international financial transactions for them, using your personal bank or building society account

No company should ask you to carry out international financial transactions for them, using your personal bank or building society account

‘Don’t be fooled’ Money Mule video https://www.moneymules.co.uk/what-is-a-money-mule.html *

![]() Identity theft happens when fraudsters access enough information about someone’s identity (such as their name, date of birth, current or previous addresses) to commit fraud. Fraudsters open accounts, apply for credit and order goods or services which can leave the innocent party responsible for the debt. They can also take over your personal accounts, order new cards and re-register for online banking to allow them to make payments to their own accounts. Identity theft can take place whether the fraud victim is alive or deceased.

Identity theft happens when fraudsters access enough information about someone’s identity (such as their name, date of birth, current or previous addresses) to commit fraud. Fraudsters open accounts, apply for credit and order goods or services which can leave the innocent party responsible for the debt. They can also take over your personal accounts, order new cards and re-register for online banking to allow them to make payments to their own accounts. Identity theft can take place whether the fraud victim is alive or deceased.

If you are a victim of identity theft, it can lead to fraud that can have a direct impact on your personal finances and could also make it difficult for you to obtain loans, credit cards or a mortgage until the matter is resolved.

How to protect yourself from identity theft:

![]() Always dispose of documents, like bank statements and mobile phone bills, containing personal information securely

Always dispose of documents, like bank statements and mobile phone bills, containing personal information securely

![]() Update your passwords regularly to ensure your account is as safe as possible

Update your passwords regularly to ensure your account is as safe as possible

![]() Never write your full personal details or your account details in an email to us, or anyone else

Never write your full personal details or your account details in an email to us, or anyone else

Social media tips

An easy way for fraudsters to find information about you is on social media. Fraudsters use social media to gather information about victims including addresses, names and check-in locations.

![]() Try not to overshare personal information on a public setting on social media sites

Try not to overshare personal information on a public setting on social media sites

![]() Review your social media privacy settings regularly, including updating passwords on phones and personal computers. Information you post online could leave you susceptible to fraud

Review your social media privacy settings regularly, including updating passwords on phones and personal computers. Information you post online could leave you susceptible to fraud

This is when someone gives you a cheque they know you can’t cash and will bounce once in the cheque clearing system. There are several types of this scam including:

- Counterfeit cheques, which are made to look real by the fraudster, or forged cheques, which are genuine but stolen from somebody else with a fake signature

- An altered or tampered cheque might not be noticeable or visible to the naked eye, but will be rejected by the bank

- Making overpayments to you and then asking for the change - a fraudster will pay you using a fake cheque for more than the agreed value, with an excuse for the overpayment. They'll ask you to send back the difference, in cash or an untraceable money transfer and then the cheque will bounce and the fraudster will vanish

A few tips on how to protect yourself from cheque fraud:

![]() Only accept cheques from people you know and trust

Only accept cheques from people you know and trust

![]() Ask for a different means of payment if it involves a lot of money

Ask for a different means of payment if it involves a lot of money

![]() Use a pen when writing a cheque - write clearly and put a line through empty spaces

Use a pen when writing a cheque - write clearly and put a line through empty spaces

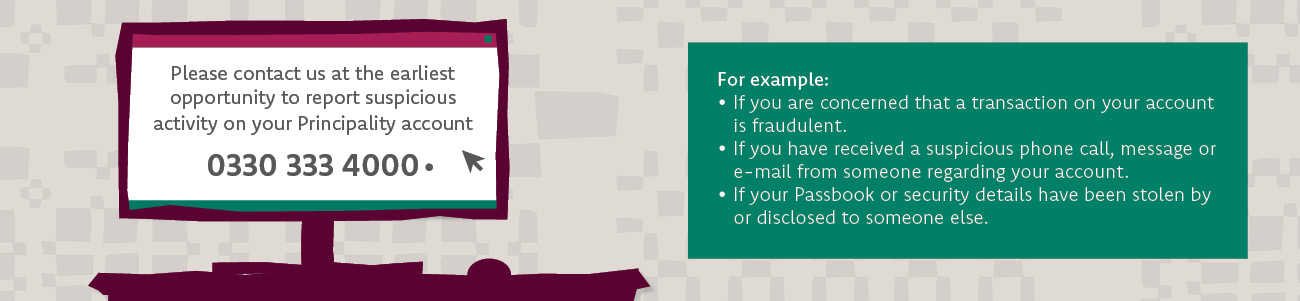

Please call us on 0330 333 4000 if you have any worries that cheque fraud may have impacted your Principality account.

![]() Rogue traders are opportunists who call on people's doors to rip them off. They make repairs that don't need doing and often talk people into buying products that they don't want or need.

Rogue traders are opportunists who call on people's doors to rip them off. They make repairs that don't need doing and often talk people into buying products that they don't want or need.

Always be on your guard, watch out for them, you can keep your door closed to protect yourself from their scams, fraudulent activities and offers that are quite literally – too good to be true.

Rogue traders will often use known tricks including:

- Turning up uninvited, putting pressure on you to agree to having work done

- Offer cheap quotes or estimates that they won't put in writing

- Tell you that the work is needed urgently to prevent further damage to your home for example, roof or gutters are leaking

- Offer to start work almost immediately

- Demand money up front, or full payment before the work is complete

- Refuse to leave your home unless you agree to the work or return repeatedly to apply more pressure

A few tips on how to protect yourself from rogue traders:

![]() Always check the identity of doorstep callers

Always check the identity of doorstep callers

![]() Always ask for a written quote and compare to other traders

Always ask for a written quote and compare to other traders

![]() Never agree to work being done or hand over cash on the spot

Never agree to work being done or hand over cash on the spot

![]() Never let anyone into your home unless they are someone you know and trust and keep your belongings safe during any work

Never let anyone into your home unless they are someone you know and trust and keep your belongings safe during any work

![]() Never agree to go to the bank or building society with the trader to withdraw money

Never agree to go to the bank or building society with the trader to withdraw money

![]() You don’t have to pay in full until you are completely satisfied with the work completed

You don’t have to pay in full until you are completely satisfied with the work completed

![]() If you are put under pressure or the trader won't leave, close the door and phone the police

If you are put under pressure or the trader won't leave, close the door and phone the police

Contact Us

Contact us straight away if you're worried someone might have access to your account. For example, if your:

- Passbook or security details have been lost or stolen

- Statement shows payments you don't recognise

If you haven't had money taken from you account, we will still take action to protect your account, for example by changing your security details.

If you are worried you have been a victim of fraud, have received a call, message or email you are suspicious about or have a concern about any transactions or your account please call us immediately on 0330 333 4000.

*By clicking on the links you will leave the Principality website - Principality is not responsible for the content of external websites.

There are also ways fraud can start, mainly trying to gather information about or from you, that could lead to one of the fraud methods explained above.

Fraudsters can make a fraud or scam look very professional, often impersonating an organisation you trust, like a bank, credit card provider or online site. A few key phrases you may have heard in relation to fraud and scams are phishing (email), vishing (phone call) and smishing (text message).

![]()

What is phishing?

Phishing emails will attempt to trick you into visiting a fake website so that they can steal your login and / or personal details.

How to identify a phishing email:

![]() Check the actual sender in the ‘from’ field – the sender email address and name may not match

Check the actual sender in the ‘from’ field – the sender email address and name may not match

![]() Check the ‘to’ field if it’s impersonal, addressing you as customer or user, then this is a warning sign as legitimate companies address by names

Check the ‘to’ field if it’s impersonal, addressing you as customer or user, then this is a warning sign as legitimate companies address by names

![]() Does the email include a threat if action isn’t taken straight away? Phishing emails contain threats, such as account closure if you don’t complete an action

Does the email include a threat if action isn’t taken straight away? Phishing emails contain threats, such as account closure if you don’t complete an action

![]() Does the email have an attachment you are not expecting? If it is a link hover your mouse over it before sending, as that way you can see if it takes you to a legitimate link

Does the email have an attachment you are not expecting? If it is a link hover your mouse over it before sending, as that way you can see if it takes you to a legitimate link

![]() Check for spelling and grammar mistakes, phishing emails often have mistakes

Check for spelling and grammar mistakes, phishing emails often have mistakes

![]() Phishing emails will often ask you to send personal details such as your login ID, password or security question

Phishing emails will often ask you to send personal details such as your login ID, password or security question

What is vishing?

Vishing is where fraudsters will try and trick you into giving them personal information over the phone by pretending to be a person or organisation you trust like a building society, HMRC or the police. Fraudsters will try to gain your trust to trick you into handing over personal or security details.

How to identify a vishing call:

![]() If you have any suspicions about a call, even if you recognise the phone number, remember that fraudsters can make a number appear on your phone screen to make it look genuine, so don’t answer

If you have any suspicions about a call, even if you recognise the phone number, remember that fraudsters can make a number appear on your phone screen to make it look genuine, so don’t answer

![]() If the caller is claiming to be from the Police, HMRC, DWP or any other government agency asking for information, please be wary. You should never be asked to provide bank details or make any payments to them during an initial call

If the caller is claiming to be from the Police, HMRC, DWP or any other government agency asking for information, please be wary. You should never be asked to provide bank details or make any payments to them during an initial call

![]() If someone asks for your online username or password end the call straight away

If someone asks for your online username or password end the call straight away

What is smishing?

Smishing will often involve a text message highlighting fraudulent activity on one of your accounts, directing you to call a number or visit a website. Fraudsters use your trust to trick you into giving them personal information. They’ll usually tell you there’s been fraudulent activity on your account and will ask you to call a number or visit a fake website to update your personal details.

How to identify a smishing message:

![]() Be careful with messages from unknown numbers. Even those that appear legitimate may not be

Be careful with messages from unknown numbers. Even those that appear legitimate may not be

![]() Ignore requests for personal information

Ignore requests for personal information

![]() Don’t reply to suspicious messages

Don’t reply to suspicious messages

![]() Beware of ‘urgent’ requests

Beware of ‘urgent’ requests

![]() Avoid hyperlinks

Avoid hyperlinks

If you're in any doubt about the emails legitimacy, don’t click on links, attachments or provide any personal or security information.

Tell us if you get a phishing email by forwarding to phishing@principality.co.uk

We will never ask you to:

- Disclose your online banking details

- Move money or transfer funds to a new sort code and account number

- Send us personally sensitive information or security information such as passwords via email, calls or texts

If you have received an email, call or text claiming to be from Principality Building Society which you are suspicious of, please call us immediately on 0330 333 4000. We will investigate every email and call and ensure that bogus websites are closed down as quickly as possible. Personal information supplied will be held in accordance with our Privacy Policy.

Take Five to Stop Fraud

Principality are proud supporters of Take Five to Stop Fraud – a national campaign run by UK Finance. Take Five offers straight-forward and impartial advice to help everyone protect themselves from preventable financial fraud.

Many people may already know the dos and don’ts of financial fraud and scams – that no-one should ever contact them out of the blue to ask for their PIN or full password, or ever make them feel pressured into moving money to another account. Take Five urges you to stop and consider whether the situation is genuine – to stop and think if what you’re being told really makes sense.

Led by UK Finance, and backed by Her Majesty’s Government, the campaign is being delivered with and through a range of partners in the UK payments industry, financial services firms, law enforcement agencies, telecommunication providers, commercial, public and third sector organisations.

Visit the Take Five website for more information and tips.

STOP

Taking a moment to stop and think before parting with your money or information could keep you safe.

CHALLENGE

Could it be fake? It’s ok to reject, refuse or ignore any requests. Only criminals will try to rush or panic you.

PROTECT

Contact your bank immediately if you think you’ve fallen for a scam and report it to Action Fraud.

Useful Related Links

Questions & Comments

- If you have any questions or comments, or want more information, you can call us. See our Contact Us page for more details. Or you can contact our Data Protection Officer as follows. Email: DPO@principality.co.uk or Post: Principality Data Protection Officer, Principality Building Society, Principality House, The Friary, Cardiff, CF10 3FA.