7 August 2019

Principality assets reach £10bn as it continues to invest in the future

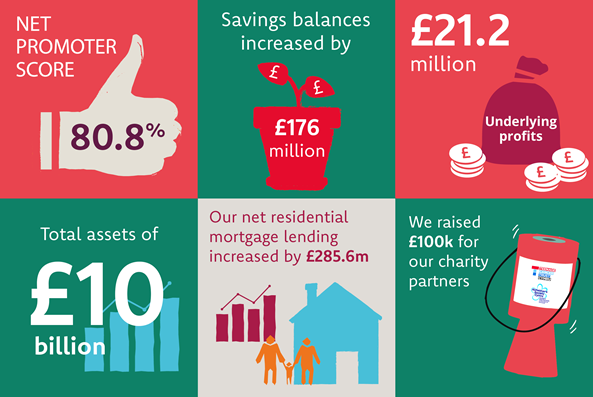

Principality Building Society has announced good half-year results as the strategy of growing its core mortgage and savings business continues to deliver. Net retail mortgage lending increased by £285.6m in the first six months of this year, bringing total assets to more than £10bn for the first time in the building society’s history.

To support the growth in its lending the Society raised £315m of wholesale funding and grew retail savings by £176m, maintaining its position as having one of the most competitive savings rates on the High Street.

Underlying profit before tax was £21.2m compared with £27.4m for the six months to June 2018 and is in line with internal expectation. This reduction was planned and previously communicated to Members and is driven by:

• Significant investment in the modernisation of mortgage and savings technology and branches to meet the changing needs of Members.

• Higher interest costs from continuing to pay better than average savings rates to Members and the costs from securing longer-term wholesale funding.

• The run-off of the secured loans portfolio as Principality deploys capital into retail mortgage lending.

Statutory profit before tax was £19.8m (June 2018: £24.9m) which has been impacted by the above factors together with fair value movements in derivatives.

For the second year running Principality has won the What Mortgage award for Best Building Society Customer Service 2019. This is reflected in the Society’s Net Promoter Score which has further improved to 80.8% (31 December: 78.6%). Eight out of 10 Members say they would recommend Principality to family or friends based on their level of satisfaction.

Interim Results 2019 - Performance Highlights

Steve Hughes, Chief Executive of Principality Building Society, said:

“I am proud of the performance of my colleagues in the first six months as our excellent customer service once again makes us stand out from our competitors. We have delivered growth against a backdrop of a highly competitive mortgage and savings market, uncertainty over potential base rate changes and Brexit negotiations.

“We remain committed to the High Street in Wales and the borders, while major banks have withdrawn. For us to maintain our presence it is important our Members continue to use and value their local branches and recommend us to family and friends so we continue to grow our Society. We have actually seen branch transactions increase in the first six months of the year and we know our Members value our great personal service.

“Our Commercial team has once again made an outstanding contribution to help build our communities, by making £50m available in competitive loans to help smaller housing developers build homes across Wales. In light of increasing demand we have topped up the fund committed to housing associations in Wales and now have £75m available which will enable them to press ahead with creating much-needed affordable homes. Their outstanding efforts have made a significant contribution towards addressing the Welsh Housing Agenda this year and is a shining example of how Principality is making a difference to our communities.”

Fundraising for its two charity partners, Teenage Cancer Trust Cymru and Alzheimer’s Society Cymru, got off to a winning start as Principality donated £10,000 for each of the five victories by Wales as they completed the rugby union Six Nations Grand Slam. Colleagues raised a further £50,000, taking the total to an impressive £100,000 in the first six months of the partnership.

Principality has partnered with 18 secondary schools across Wales, investing £160,000 and helping thousands of school children to earn the equivalent of a GCSE in financial education.

Lessons include household budgeting workshops, financial planning, insurance, pensions, as well as preparing students for adulthood and the world of work.

Principality has already helped more than 16,000 secondary students in Wales as part of the Business in the Community Business Class program since 2016.

Steve said:

"I am very proud of the efforts our colleagues have made to improve the lives of others. It is what we stand for as an organisation. Our investment in financial education, for example, is critical to equipping young people for their lives ahead. Our people are our most important asset and make us stand out in the sector, and our efforts to create a diverse and inclusive workplace saw us acknowledged once again as one of the best places to work in the UK."

Looking to the second half of the year Steve added:

“We will continue to seek to grow and invest in our business in a safe and sustainable way for our Members and to make sure we are in a strong position for current and future generations of Members.

“We expect economic and political uncertainty to continue over the next six months and price competition in the mortgage and savings markets to remain high. Any reduction in the UK base rate would also cause further pressure on margins and could result in changes to rates offered to our Members. Despite these challenges, our profitability and balance sheet position remains robust and our performance in recent years has built a solid foundation for us to invest for the future.”

Click on the link to download our Half Year Accounts 2019

Transcript for Interim Results 2019 - Performance Highlights

• Total assets reached £10.1bn (31 December 2018: £9.7bn)

• Retail mortgage balances of £7,779.8m (31 December 2018: £7,494.3m)

• Savings balances have increased by £176.0m (30 June 2018: £309.3m)

• Gross retail mortgage lending for the first six months of the year of £795.8m (30 June 2018: £912.9m)

• Statutory profit before tax of £19.8m (30 June 2018: £24.9m)

• Underlying profit before tax of £21.2m (30 June 2018: £27.4m)

• 81.3% of mortgages funded by savers (30 June 2018: 84.1%)

• Strong capital with a Common Equity Tier 1 ratio of 24.73% (30 June 2018: 25.21%)

• Customer Service Net Promoter Score of 80.8% (30 June 2018: 79.2%)

• Net interest margin of 1.15% (30 June 2018: 1.29%)

• We raised £100,000 for charity

Published: 07/08/2019

Why Principality?

- 6th largest UK building society

- A mutual building society, owned by and run for the benefit of our 500,000 members

- Over 160 years' experience

- Taking care of over £12 billion of our customers' assets

- Members can access a Member Rewards page featuring competitions, discounts and more.